Toronto, Ontario (December 12, 2024) – Rupert Resources Ltd. (TSX: RUP) (the “Company”) today provides an update on the Prefeasibility Study (“PFS”) for its flagship Ikkari Project as well as a summary of its exploration programs as Central Lapland enters the key winter drilling season

Graham Crew, new Chief Executive Officer of Rupert Resources says “After two months in the role, I am more excited than ever about the opportunities at Ikkari and across our 100% owned land package. We are in the final stages of completing the PFS for Ikkari and plan to publish the report in the first quarter of 2025. Planning for the DFS will commence immediately thereafter. We are looking forward to our key winter drilling season in early 2025, during which we plan to return to Heinä South and test targets east of Ikkari identified through a new geophysical survey.”

2024 Highlights

2025 catalysts

Ikkari project update

The company is in the final stages of completing its PFS for Ikkari with critical path items including mine, mill and waste facility design finished and final review underway. The study will be published in Q1 2025 with work on a Definitive Feasibility Study planned to commence shortly afterwards. The Environmental Impact Assessment (EIA) Report is planned for submission in H2 2025, with excellent progress on the EIA program over 2024.

Exploration update

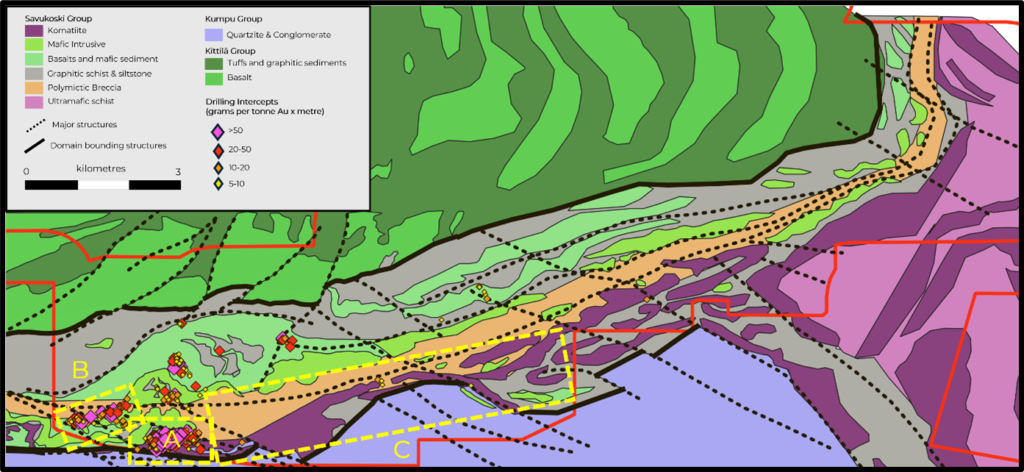

The focus of the exploration team over the last few months has been the progression of a number of key targets along the main regional structure east of Ikkari (“The Rajala Line”). Previous scout drilling has confirmed the same intercalated ultramafic and sedimentary units that host the Ikkari deposit up to 15km along strike to the east. During the Autumn, a wide spaced Induced Polarization (IP) survey was undertaken to identify areas at depth that exhibit a similar structural setting to Ikkari (Figure 1). The survey has successfully outlined several locations along strike which share a similar large-scale structural setting to that at Ikkari. Given that these do not sub-crop below the glacial till they would not be expected to present a Base of Till (BoT) anomaly which has been the primary targeting tool for the other seven discoveries in Area 1. Follow-up drill testing of these settings will be prioritized in 2025. During Q1 2025 focus will also return to Heinä South where drilling intersected 25m at 16.5g/t Au in hole 124019 (see press release 3 March 2024) and 24.4m at 10.5g/t Au in hole 124061 (see press release May 1, 2024) during the previous drill campaign. The objective of the follow up drilling will be to establish a control to the high-grade mineralisation following a detailed geological review of the 2024 program.

Figure 1: Exploration Targets Winter 2025 (A: Ikkari Deposit, B: Heina South, C: Rajala Line IP survey area)

December 10, 2024

Rupert Resources Ltd (“Rupert” or the “Company”) today announces that it is changing its fiscal year-end from end-February to end-December.

The Company is changing its financial year-end to better align the Company’s financial statement and continuous disclosure requirements with its industry peers, as well as its other external reporting obligations, including sustainability reporting. As a result, the Company expects to file its annual disclosures in late March 2025 for the 10 months ended December 31, 2024, including audited financial statements and in accordance with National Instrument 51-102 – Continuous Disclosure Obligations (“NI 51-102”).

Further details regarding the change in fiscal year-end, including the Company’s interim reporting procedures, will be available in the Company’s Notice of Change of Financial Year-End, prepared in accordance with section 4.8 of NI 51-102, which will be filed on the Company’s profile on SEDAR at www.sedarplus.ca.

October 11, 2024

Rupert Resources Ltd (“Rupert” or the “Company”) announces that it has published its unaudited financial results for the three and six months ending August 31, 2024 and accompanying Management’s Discussion and Analysis for the same period.

All of the above have been posted on the Company’s website www.rupertresources.com with the financial statements and MD&A also published on SEDAR+ at www.sedarplus.ca

James Withall, Chief Executive Officer of Rupert Resources said “Following the completion of the successful financings over the summer the company remains well funded heading into the winter drilling season and CEO transition with a cash balance of $52M. The PFS for Ikkari continues to progress with critical path items substantially complete. Review and optimisation work will be undertaken in Q4 2024 by the incoming CEO.”

Financial Highlights

During the six months ending August 31, 2024, the Company spent $17,711,186 on its exploration projects. As of August 31, 2024, Rupert held cash or cash equivalents of $52,422,385. The Company recorded a net loss and comprehensive loss for the three and six months to end-August 2024 of $(1,453,606) and $(2,199,432) respectively and a net loss per share of $(0.01) and $(0.02) respectively.

All references to currency in this press release are in Canadian dollars.

Discussion of Operations

During the three and six months ended August 31, 2024 and up to the date of this document, Rupert’s operational activities have been focussed on the Rupert Lapland Project Area and Ikkari in particular.

Rupert Lapland Project Area

Regional Exploration Program, including Ikkari

The regional exploration program at the Rupert Lapland Project Area is designed to identify and evaluate the mineral potential contained in Rupert’s land package in the CLGB.

Since July 2020 the Company has been engaged in a diamond drill program to further evaluate discoveries made within the Rupert Lapland Project Area, including Ikkari, as well as continuing to generate new targets through base of till (“BoT”) sampling, which continues across the Rupert Lapland Project Area and specifically over geophysical anomalies of interest.

The Updated Ikkari MRE has served as the basis for the Pre-feasibility Study (“Ikkari PFS”) that was initiated during the twelve months ended February 29, 2024.

Ikkari Project Drilling

The 2023/24 drill program was completed during the second calendar quarter of 2024, comprising some 43,000 metres (“m”) of drilling, with 24,000m allocated to drilling within the Ikkari project footprint.

During the 2024/25 drill season the focus of Ikkari project drilling will be on ensuring a thorough understanding of the short-spaced grade variability, the hydrogeological environment and geotechnical domains to facilitate the full optimisation of the project at the definitive feasibility study stage which is expected to follow on from successful completion of the Ikkari PFS.

Continuing Exploration

Following on from the success of the exploration campaign during the winter 2023/24, the discovery of significant widths and tenors of mineralisation at Heinä South, and the structural reinterpretation of the wider Area 1, the 2024/25 exploration program is now underway with drilling planned at six target areas along the 15km regional trend east of Ikkari as well as two base metals target areas located at the east of Rupert’s 100% property. The aim of the upcoming season is to systematically explore extensions to the prospective structures identified in an updated structural interpretation.

Engineering and PFS update

In August final metallurgical variability and bulk testwork results were released providing evidence of favourable recoveries using the proposed gravity and whole ore leach flow sheet that will be applied in the upcoming PFS. Other critical path work has been substantially finished and review and optimisation work will be undertaken in calendar Q4 2024.

Advancing Permitting and Environmental Work

Permitting, specifically progression of the Environmental Impact Assessment (“EIA”) Programme and Land Use Planning is also a key focus of the Company. The EIA Programme was initially presented to the respective authorities on November 30, 2022 and formally started the environmental permitting process, with the aim of securing an environmental permit and thereafter a mining licence for Ikkari, in addition to those already held at Pahtavaara. The Company formally filed an EIA Programme with authorities during the second calendar quarter of 2023 and plans to file EIA report documents during 2025.

As part of this process the Company continues with numerous baseline environmental assessments, as well as on-going engagement across all stakeholder groups. The Ikkari PFS is drawing from these processes as appropriate.

Toronto (September 3, 2024) – Rupert Resources Ltd. (“Rupert” or the “Company”) provides an update on the Ikkari project demonstrating exceptional gold recoveries, further significant drill intercepts and an exploration update and outlook for the upcoming season.

Highlights

Ikkari Metallurgy

Ikkari Drilling

Regional Exploration

James Withall, CEO of Rupert Resources commented “As we work towards completion of the PFS, the best-in-class metallurgical results reported today show the potential to further increase the future revenues from Ikkari whilst at the same time simplifying the process plant design. We have also published further drilling results which confirm the exceptional grade and continuity in the upper levels of the Ikkari orebody and indicate satellite orebody potential 1km to the northwest at Heinä South. After a summer of field mapping and sampling, drilling has now recommenced on our regional exploration targets and the team have a number of high priority programs as we head into the autumn and winter season.”

Toronto (August 28, 2024) – Rupert Resources Ltd. (“Rupert” or the “Company”) announces an upcoming senior management change with the appointment of Graham Crew as the new Chief Executive Officer and Director effective from October 14, 2024, to lead the next stage of development of Rupert Resources.

Mr Crew will succeed James Withall, who joined the company as Chief Executive Officer (“CEO”) in April 2017 and has decided to step down. Mr Withall will continue to act as an advisor to the Company and the Board led Technical Committee ensuring a smooth transition for the incoming CEO, after stepping down from the Board of Directors on October 14, 2024.

James Withall, outgoing CEO commented: “The past seven years have been incredibly rewarding and I am extremely proud of what we have achieved. The company has undergone a transformative change having made one of the most significant greenfield gold discoveries of the past ten years and Ikkari is now well on the path towards development of a long-life, high-margin cornerstone project on which to build a leading natural resource company. At Rupert we focus on value creation and returns for all stakeholders, a key element in achieving that goal is having the right people in the right positions at the right time. We have been able to attract a very talented team who share a vision of exploring for meaningful mineral deposits and developing modern, future-fit mining operations in northern Finland. Graham is ideally qualified to provide the leadership and technical experience to further the success of the Company through the critical engineering and permitting phases. As a long-term investor in the mining sector I strongly believe that succession in senior roles is an important driver of the success of a business, bringing new ideas and ensuring the necessary skills are in place to lead the critical investment decisions that are required. I look forward to seeing Graham and the team continue to add value to Rupert Resources through further exploration discovery and the development of a best-in-class mine of the future.”

Gunnar Nilsson, Non Executive Chairman: “I would like to thank James for the leadership and vision he has brought to Rupert Resources. The strategy to undertake large scale regional systematic exploration in a timely, disciplined and dynamic way delivered the 4Moz Ikkari discovery and a number of other grassroots gold discoveries demonstrating the geological and economic potential of the Rupert land holdings. Furthermore, the culture and values that have been built with the team and relationships the company has developed with stakeholders under his tenure provides strong foundations for the future. The Board of Rupert Resources is very pleased to welcome Graham Crew to the Company. His extensive experience in operations, project development and most recently as a Chief Technical Officer for the La Mancha group are key requirements for leading the company through the next stage of its evolution. He brings strong leadership experience matched with an understanding of the importance to focus on shareholder returns and stakeholder engagement from multiple international roles. Exploration and adding to the critical mass of resources of Ikkari will remain a key part of the business model. ”

Toronto, Ontario (August 6, 2024) – Rupert Resources Ltd. (“Rupert Resources” or the “Company”)

announces that the six nominees listed in its management information circular (the “Circular”) dated

July 4, 2024 were elected as directors at the Annual Meeting of Shareholders of Rupert Resources (the

“Meeting”). There were 89,983,173 common shares represented in person or by proxy at the Meeting

(representing 44.03% of the issued and outstanding common shares of the Corporation being

204,374,706 as of the record date for the Meeting). The voting results for the Meeting are set out below.

At the Meeting, the following resolutions as set out in the Circular, were passed as ordinary resolutions

of Rupert’s shareholders. Proxies and votes received at the Meeting were as follows:

| DIRECTOR | FOR | WITHHELD | ||

| Gunnar Nilsson | 85,207,948 | 96.78% | 2,836,397 | 3.22% |

| Michael Ouellette | 86,087,847 | 97.78% | 1,956,498 | 2.22% |

| Andre Lauzon | 86,999,152 | 98.81% | 1,045,193 | 1.19% |

| William Washington | 86,997,652 | 98.81% | 1,046,693 | 1.19% |

| Riikka Aaltonen | 88,000,037 | 99.95% | 44,308 | 0.05% |

| James Withall | 60,217,498 | 68.39% | 27,826,847 | 31.61% |

Appointment of Auditors:

An ordinary resolution to appoint MNP LLP to serve as the independent auditors of the Corporation and

authorizing the directors of the Corporation to fix the auditors’ remuneration was also approved by ballot.

Based on proxies and votes received at the Meeting, 89,940,170 common shares (approximately

99.95%) voted “for”, and 43,003 common shares (approximately 0.05%) “withheld”.

The results of the matters considered at the Meeting are reported in the Report of Voting Results as filed

under the Company’s issuer profile on SEDAR+ (www.sedarplus.ca) on August 6, 2024.

NOT FOR DISTRIBUTION TO U.S. NEWSWIRE SERVICES OR FOR RELEASE, PUBLICATION, DISTRIBUTION OR DISSEMINATION DIRECTLY, OR INDIRECTLY, IN WHOLE OR IN PART, IN OR INTO THE UNITED STATES.

TORONTO, ON – (BUSINESS WIRE) – August 1, 2024 – Rupert Resources Ltd. (TSX:RUP) (“Rupert” or the “Company”) is pleased to announce that it has closed the previously announced private placement of 1,799,329 common shares in the capital of the Company (the “Shares”) issued at a price of $3.58 per Share for gross proceeds of $6,441,597.82 (the “Private Placement”).

The net proceeds of the Private Placement will be used for on-going exploration expenditures, technical and environmental studies on the Company’s properties in Finland and for general corporate purposes as set out in the Prospectus.

The Private Placement remains subject to the final approval of the Toronto Stock Exchange.

This press release is not an offer or a solicitation of an offer of securities for sale in the United States. The Shares have not been and will not be registered under the United States Securities Act of 1933, as amended, and may not be offered or sold in the United States absent registration or an applicable exemption from registration.

NOT FOR DISTRIBUTION TO U.S. NEWSWIRE SERVICES OR FOR RELEASE, PUBLICATION, DISTRIBUTION OR DISSEMINATION DIRECTLY, OR INDIRECTLY, IN WHOLE OR IN PART, IN OR INTO THE UNITED STATES.

TORONTO, ON – (BUSINESS WIRE) – August 1, 2024 – Rupert Resources Ltd. (TSX:RUP) (“Rupert” or the “Company”) is pleased to announce that it has closed the previously announced “bought deal” public offering of 8,030,700 common shares in the capital of the Company (the “Shares”) issued at a price of $3.58 per Share for gross proceeds of $28,749,906.00, which included the exercise, in full, of the Underwriters’ over-allotment option (the “Offering”). The Offering was conducted by Cormark Securities Inc. and BMO Capital Markets, as co-lead underwriters and joint bookrunners, and Canaccord Genuity Corp. (collectively, the “Underwriters”).

The Offering was completed pursuant to a short form prospectus dated July 26, 2024 (the “Prospectus”) in British Columbia, Alberta, Ontario, New Brunswick and Newfoundland and Labrador and in the United States on a private placement basis pursuant to an exemption from the registration requirements of the United States Securities Act of 1933, as amended, andin offshore jurisdictions on a private placement basis as agreed upon by the Company and the Underwriters, in each case in accordance with all applicable laws.

The net proceeds of the Offering will be used for on-going exploration expenditures, technical and environmental studies on the Company’s properties in Finland and for general corporate purposes as set out in the Prospectus.

The Offering remains subject to the final approval of the Toronto Stock Exchange.

This press release is not an offer or a solicitation of an offer of securities for sale in the United States. The Shares have not been and will not be registered under the United States Securities Act of 1933, as amended, and may not be offered or sold in the United States absent registration or an applicable exemption from registration.